Frequently Asked Questions

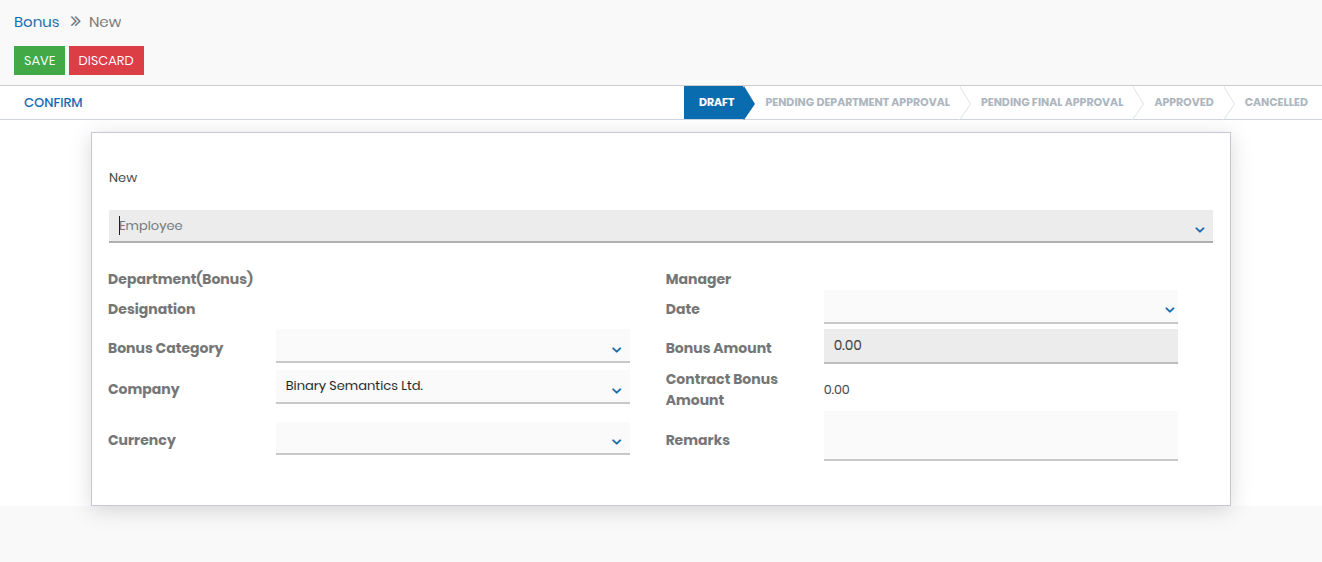

What is Payroll Management?

Payroll Management is a system that automates employee salary processing, including calculations of allowances, deductions, and statutory contributions. It ensures timely, accurate payments and compliance with legal requirements.

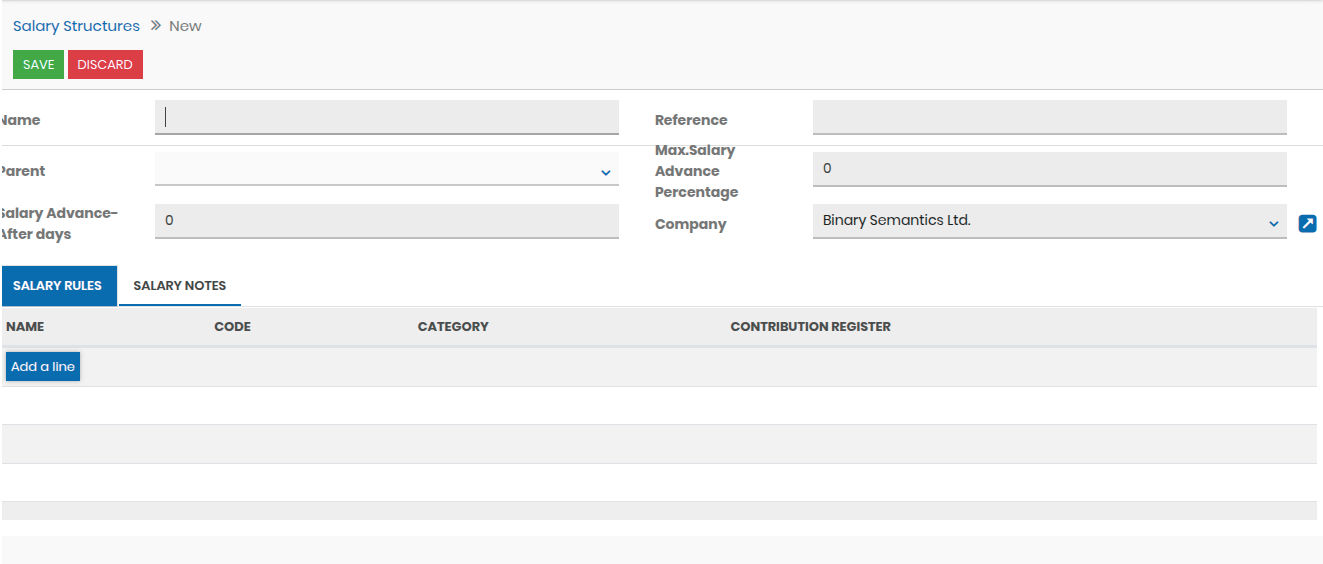

How does Payroll Management ensure compliance?

The system automatically calculates taxes, provident fund (PF), employee state insurance (ESI), and other statutory obligations. This reduces errors, ensures adherence to regulations, and minimizes legal risks.

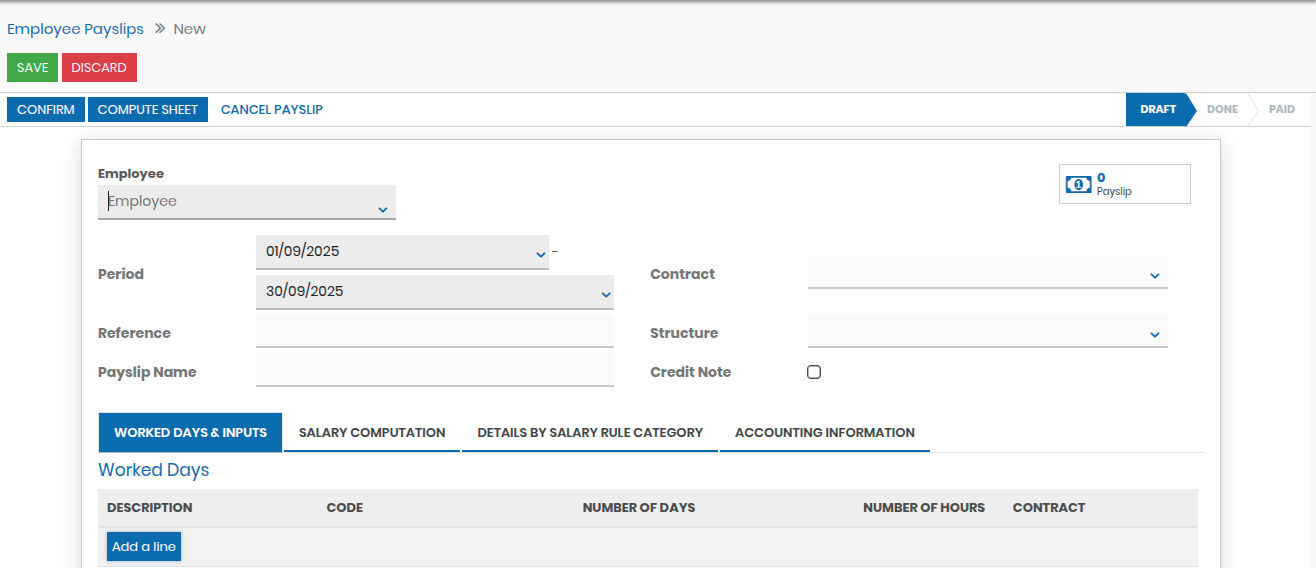

Can employees access their salary details?

Yes, employees can view their payslips, salary history, and tax details directly through the self-service portal, enhancing transparency and reducing administrative workload.

How is payroll integrated with other systems?

The payroll system integrates with attendance, leave management, accounting, and banking systems. This ensures seamless salary disbursement and accurate record-keeping across all platforms.

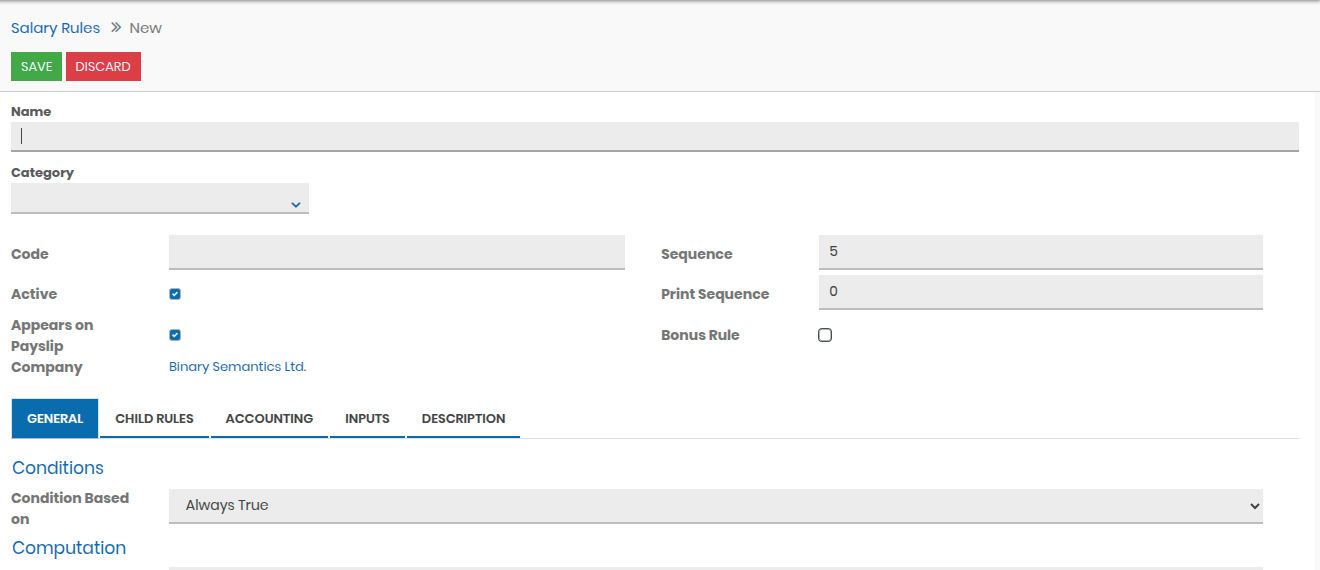

What are the key benefits of using this payroll system?

Benefits include automated salary calculation, compliance with statutory regulations, reduced manual effort, error-free payroll processing, secure salary disbursement, and enhanced reporting for HR and finance teams.